Financing for high-growth companies is a challenge that has not been easy to solve. An innovative solution that has emerged is revenue-based financing (RBF). Through this model, startups and high-growth companies can find funding to develop products or invest in marketing. It can be a much more feasible tool in the form of debt than a bank loan. It is also an alternative to a new round of capital that could dilute and distract the founding team too much.

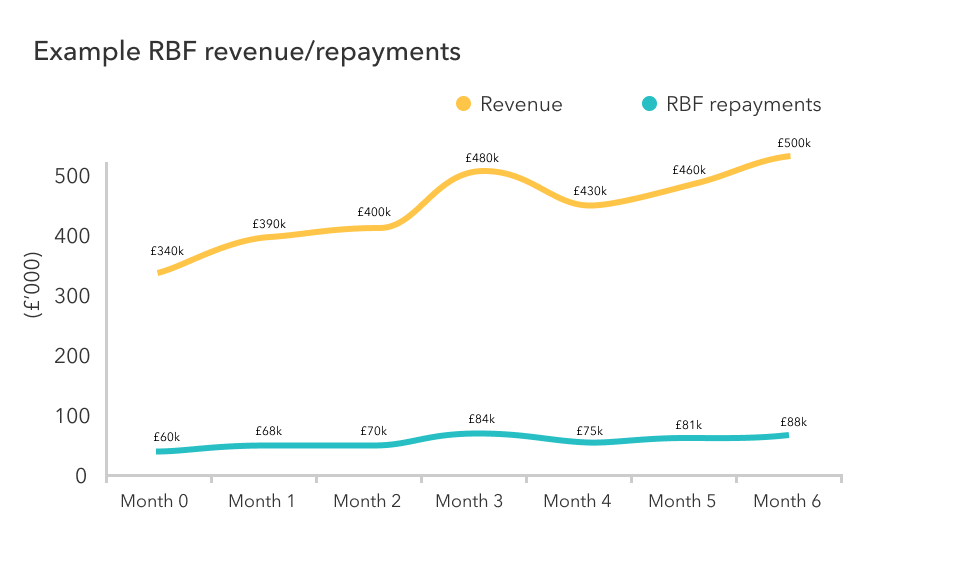

Revenue-based financing allows companies, especially those with subscription-based models, to leverage their anticipated future cash flows to secure funding. It is a type of loan that is repaid over time; however, instead of fixed monthly installments like those of a typical bank loan, in this case, the payments are usually structured as a percentage of the monthly revenue, and therefore become variable payments that adjust to the business’s income streams.

Advantages of Revenue-Based Financing

Among the advantages of this financing for startups and high-growth companies are:

- The founding team can retain ownership of the company: since equity is not diluted, the founding team maximizes its gains in the event of a future sale of the company.

- It is a viable alternative to the nearly impossible bank loan: for companies still operating at a loss, bank financing is not an option, but this instrument can be.

- It is usually quick and does not require personal guarantees: the founding team saves time on valuations and negotiations with investors.

- There is no need to justify the use of the requested amount: additionally, in debt repayment, flexible payments based on revenue make cash flow management easier.

A growing financing option

This is undoubtedly a financing model that is on the rise. In 2023, its volume was $3.38 billion (according to the Revenue-Based Financing Global Market Report by The Business Research Company). It is projected that in 2024 it will increase by no less than 70% to reach $5.8 billion. Furthermore, this growth is expected to continue, with a CAGR of 64% through 2028, reaching a transaction volume of $42 billion in 2028.

In an economic situation of high uncertainty for companies, it is becoming increasingly clear how important it is to have adaptable and favorable financing solutions for businesses. Revenue-based financing offers the necessary flexibility and accessibility for many small businesses and startups to reduce their financial stress amid a scarcity of credit and capital. As we have seen, it is a very suitable financing option for high-growth companies. It not only provides the necessary capital for growth but does so in a way that is aligned with the financial reality of startups.

f you want to learn more, you can download this article from Harvard Deusto Business Review