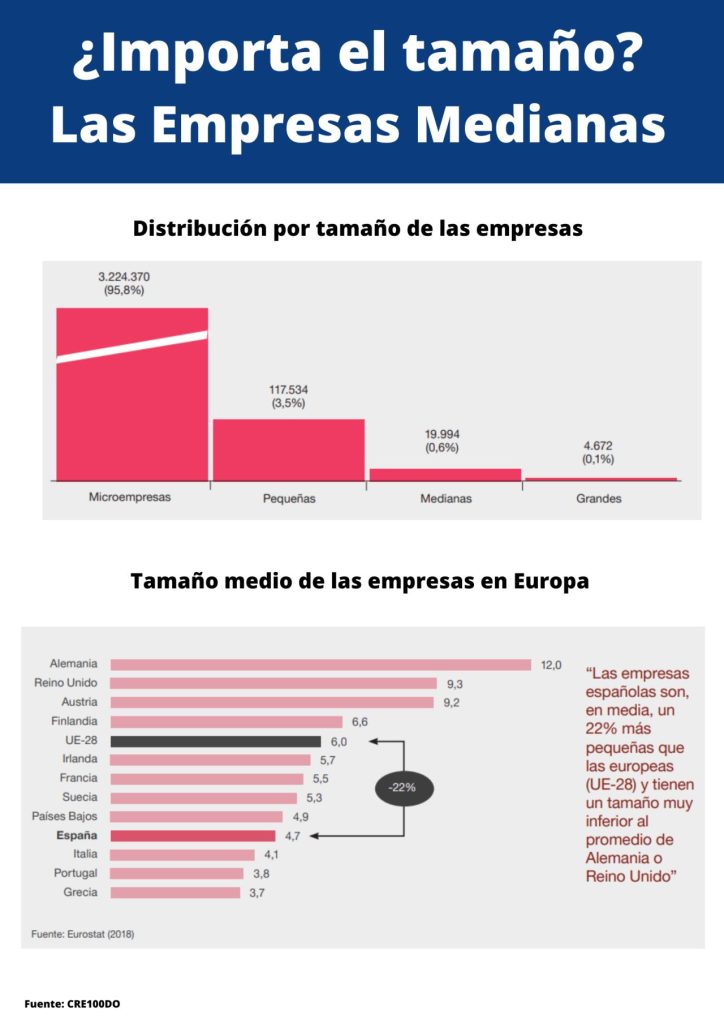

The Spanish economy is based on SMEs. Not only do they represent 99.8% of the total number of companies, but also 62% of Gross Value Added (GVA) and 66% of total business employment. However, one of the drawbacks for economic growth in our country is the low percentage of medium-sized companies and an excessive concentration of companies that are too small in size.

In Spain, there are fewer than 20,000 medium-sized companies, considering in this segment those with between 51 and 250 employees. If we add as a criterion those with a turnover of more than 50 million euros, the figure drops to only 3,300, and if we exclude those that are not foreign subsidiaries, the total does not exceed 1,800.

There is a direct relationship between the size of companies and the development of a country’s economy, since an increase in volume favours investment in innovation and therefore productivity, which impacts, among other aspects, on better jobs and real wages. Larger size also correlates with higher survival rates in times of economic crisis. In terms of financing, size undoubtedly also matters, since, in addition to better risk assessment by traditional banks, there is also greater availability of alternative financing, with many financial providers dedicated to this segment. Thus, we can count on direct lending funds for these medium-sized companies with the possibility of loans from one million euros and great flexibility in their repayment, and a wide variety of possibilities depending on the need, economic sector and guarantees provided. Having a financial advisor such as Altria Corpo will help to obtain the best alternative according to each circumstance.