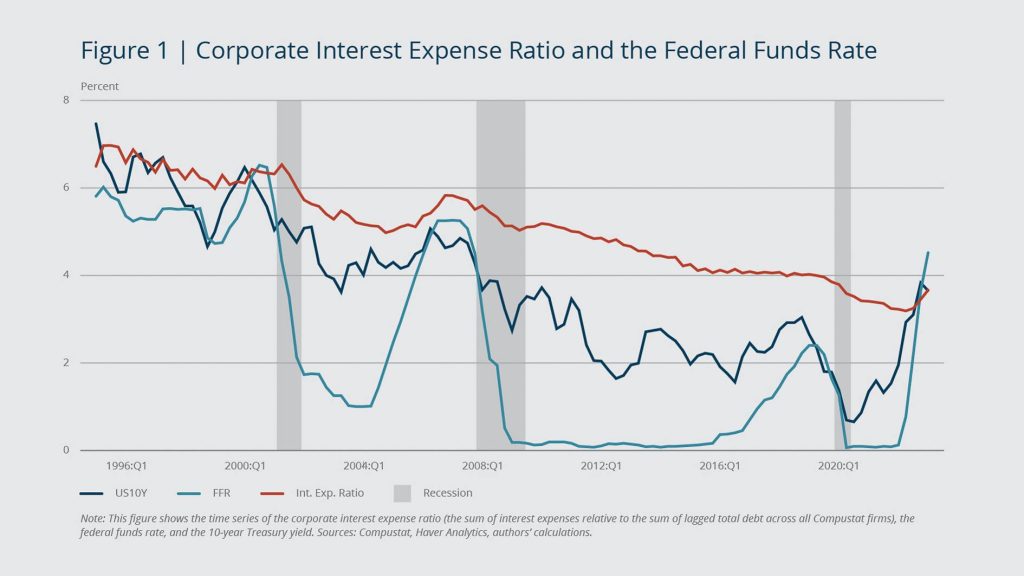

5 quarters. That’s the time it will likely take for the interest rate hikes by the U.S. Federal Reserve to fully impact the interest expenses of companies, according to a new study by the Federal Reserve Bank of Boston (see the study in English here). This is the reason why, after a year and a half of implementing anti-inflationary measures, only now are companies starting to experience an increase in the financial cost of their debt.

This delayed effect of restrictive monetary policies is also likely to be seen in the European realm. Since March 2022, both the U.S. Federal Reserve (the Fed) and the European Central Bank (ECB) began raising reference rates in an effort to curb inflation. Since then, the Fed has raised its rate from nearly zero to 5.25%, and the ECB has raised its main reference rate to 4.5% following the recent 0.25% increase on September 14th.

When central banks raise their interest rates, companies must pay higher rates on any variable interest debt they have, and on any debt they refinance. This leads to the need to offset this increased cost by reducing expenses and, in severe cases, by containing wages or laying off some of their employees. The rising cost of debt can also cause treasury difficulties and loan defaults.

The researchers of the mentioned study state that “regarding the current cycle, this finding suggests that most of the interest rate hikes have not yet been fully transferred to companies’ interest expenses.” They add that “it’s possible that the initial rate hike of 0.25 percentage points in March 2022 has fully impacted the interest expense ratio of companies, but they have not yet felt the full impact of the subsequent 5 percentage point hikes.” This contrasts with other parts of the economy, such as the real estate market and the banking system, where the high interest rates have already had an impact.

For companies, it is time to prepare for this rate hike which, in a deferred manner, will have an impact on their operating accounts and their treasury in the coming months. As always, Altria Corpo will be there to assist these companies in finding the best financial solution for these situations.