Antonio Llera, who comes from Deloitte, joins the Barcelona team to deal with higher value-added operations, and Javier Galindo and Ignacio Martín expand the Madrid team, doubling its current capacity.

2024 marks the tenth anniversary of Altria Corpo and the year begins with important additions in the Corporate Finance Area that will further boost the business, level of service and advice for medium and large companies.

In Barcelona we are very proud to have Antonio Llera, a professional with extensive experience in corporate debt advisory and restructuring. In recent years he has held the position of senior manager in the Debt Advisory and Restructuring division of two of the most renowned financial consultancies for large companies, KPMG and Deloitte. Previously, he was at Banco Santander, where he held various positions in its Corporate and Investment Banking division, as well as in Structured Finance Risk. Antonio holds a degree in Business Administration and Management from the Universidad Pontificia de Comillas (ICADE) and several postgraduate degrees in finance from the IEB and Eada Business School.

Meanwhile, in Madrid, an office we opened in the summer of 2022 with two consultants, we have decided to increase our service capacity with two new professionals, taking into account the enormous potential of the business market in the Madrid region and the greater reach it gives us for the business fabric of the rest of Spain. Javier Galindo and Ignacio Martín have joined us to add value to their experience in business financing.

Javier Galindo is a professional expert in corporate finance with special emphasis on financing solutions for capital goods and other productive assets. He has spent most of his career in the Spanish branch of the renowned German financial group AKF Bank. Previously, he worked at CESCE, Agco Finance and ALD Automotive (Société Générale Group). Javier holds a degree in Economics from the Complutense University of Madrid and a Master in Financial Management from ESIC, complemented with training in auditing, insurance and foreign trade.

Ignacio (Nacho) Martín has more than 30 years of professional experience in different sectors, always related to the financial and business world. For 14 years he worked in the banking sector as a Business Manager and Director of Business Offices in leading financial institutions. He has managed different companies, and in recent years he has broadened his experience with the management of commercial teams in the insurance sector for companies. Nacho has a law degree from the Complutense University of Madrid, complemented by courses in finance and business management at the Polytechnic University of Valencia and the Carlos III University of Madrid.

We welcome these new additions and wish them every success at Altria Corpo.

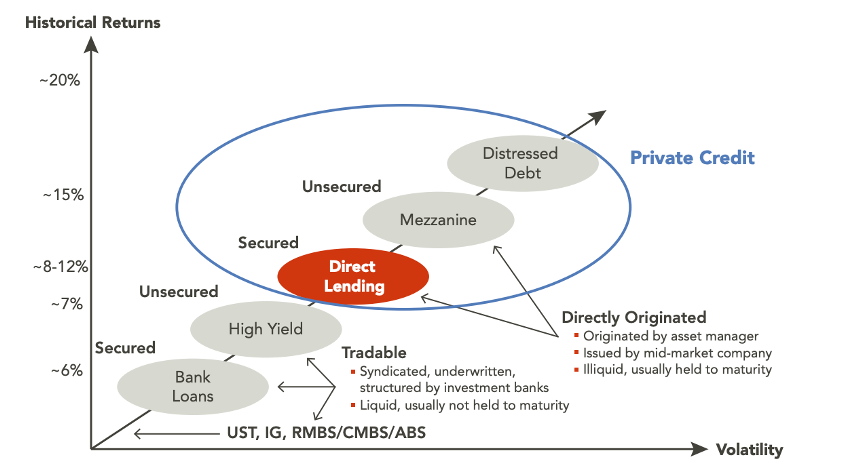

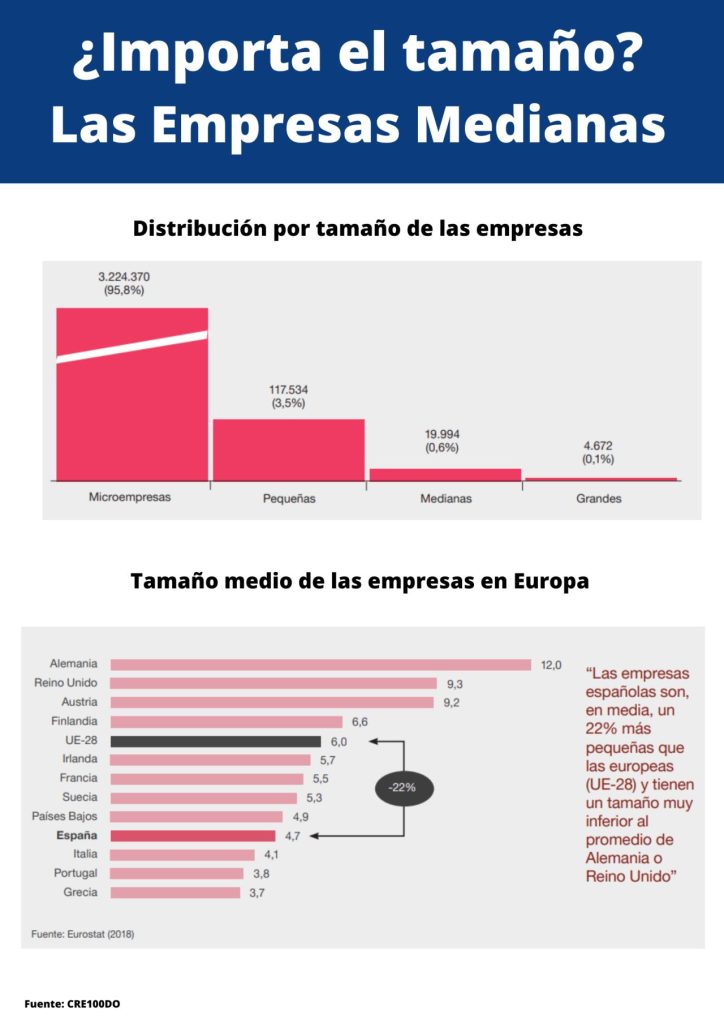

Altria Corpo is a financial consultancy for medium and large companies, founded in 2014 by Albert Gumà and based in Barcelona. Its main services are advice on debt and equity financing, and access to more than 200 financial providers including banks, alternative financing, debt funds and other instruments. In its 10 years of existence, Altria Corpo has positioned itself as a benchmark in the search for financing for medium and large companies, with an accumulated amount advised of more than 450 million and more than 800 operations. The scope of the companies advised covers the whole of Spain, with a concentration in Madrid and Catalonia, which account for 80% of the total amount advised.