The news of BBVA’s hostile takeover bid for Banco Sabadell has once again raised alarms about the high level of banking concentration occurring in Spain and the negative effects it may have on the business sector of our country. The financial function of a company plays a crucial role in this scenario, facing the challenge of managing these strategic changes effectively.

The bank takeover will surely alter the financial landscape for the client companies of the affected entities. These events lead to a consolidation in the banking sector that can result in fewer financing options for companies. Moreover, it is more than likely that the merged entities will choose to reduce their risk exposure by reevaluating their credit portfolios or modifying existing financing conditions. Given this situation, it is vital that the financial function of the company is prepared to act proactively.

Diversification of Financing Sources

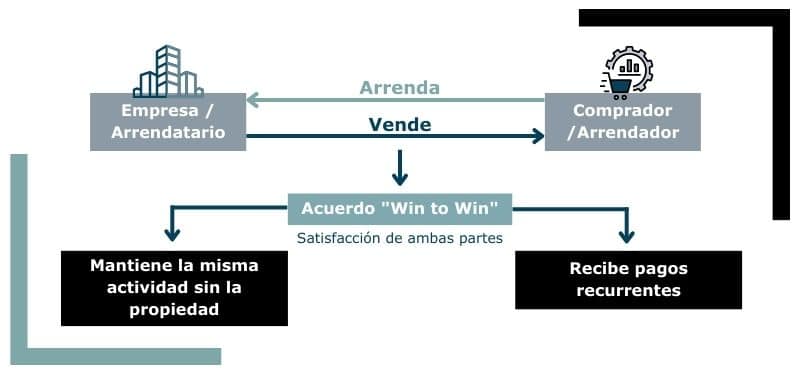

Diversifying financing sources is a fundamental strategy to mitigate the risks associated with banking concentration. Companies should consider a broader spectrum of options, including not only traditional bank financing but also alternatives such as debt funds, fintech platforms, specialized financing in factoring or leasing, and private equity solutions. This diversification helps reduce dependency on a small number of banks and offers greater flexibility in capital management.

Anticipation of Changes

Anticipating market movements and trends in banking consolidation is another key component. Companies must constantly monitor the market to foresee future takeovers and understand their possible impacts. Scenario analysis and financial planning must incorporate these possibilities, preparing the company to act swiftly in the face of imminent changes.

Partnership with Experts

In these times of uncertainty and financial complexity, partnering with a consultant specialized in corporate finance is more important than ever. An expert consultancy can provide the necessary market intelligence, as well as strategic and operational advice to navigate the challenges presented by bank takeovers. From evaluating current financing conditions to searching for viable and sustainable alternatives, a debt advisory expert like Altria Corpo can play a decisive role in optimizing a company’s financial structure.

In summary, effectively managing a bank takeover from a company’s financial function requires proactive planning and a well-defined strategy. Diversifying financing sources, constant market monitoring, and collaboration with specialized debt advisory consultants are crucial components to ensure that your company not only manages but also benefits from the constantly evolving dynamics of the banking market. At Altria Corpo, we are prepared to help companies navigate this complex environment with expert advice and customized solutions that will protect and enhance the financial health of your business.