The Institute of Financial Studies (IEF) and Altria Corpo have recently presented the results of the 5th Business Barometer on Fintech and Alternative Financing. This annual study analyzes financial sector trends and expectations regarding credit granting policies and the adoption of fintech solutions by companies.

One of the main conclusions of the report is the perceived improvement in access to bank credit. While in 2024, 73% of companies anticipated a tightening of financing conditions, by 2025 this percentage has dropped to 40%. Additionally, 16% of companies foresee greater ease in obtaining credit, compared to just 4% the previous year. This shift in perspective is attributed to a decline in interest rates and an increased willingness of banks and alternative financing providers to extend credit.

However, alternative financing has not yet achieved widespread adoption among businesses. Although 77% of companies acknowledge being aware of alternative financing providers, only 42% used such services in 2024, a decrease from 48% in 2023. The most commonly used products remain factoring and leasing, while options such as private debt funds or fintech solutions continue to be underutilized by SMEs.

Regarding fintech solutions, business awareness and usage have also declined. Only 32% of companies can name fintech providers, and just 12% used these services in 2024, compared to 22% the previous year. Expectations for 2025 are not encouraging either, as only 43% of businesses plan to seek alternative financing, compared to 56% in 2024. All of this underscores the importance of financial consulting firms like Altria Corpo, which connect companies’ financial needs with available fintech and alternative financing solutions.

In summary, while there is a positive outlook for bank credit accessibility in 2025, the adoption of alternative financing and fintech solutions still faces significant barriers.

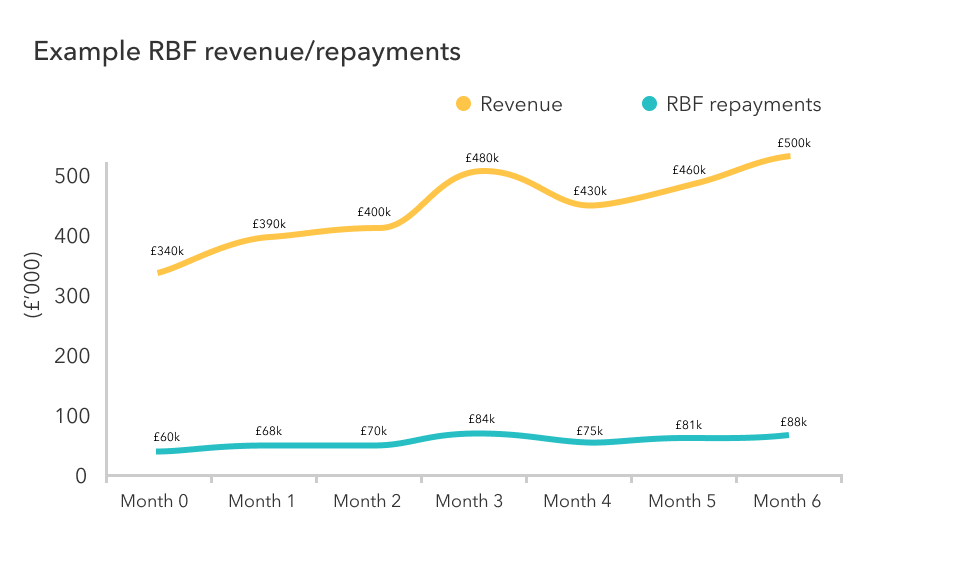

You can watch the presentation video of the results at this link or by clicking on the image above.