Altria Corpo’s partners, Albert Gumà and Ramiro Lama, and its Managing Director Eloi Noya, have prepared a working paper on direct lending that has been published by the Observatory of Financial Disclosure (ODF) of the prestigious Institute of Financial Studies (IEF).

Please find attached the link to this document: https://www.iefweb.org/es/publicacion-odf/el-direct-lending-una-alternativa-creciente-en-la-financiacion-a-empresas/

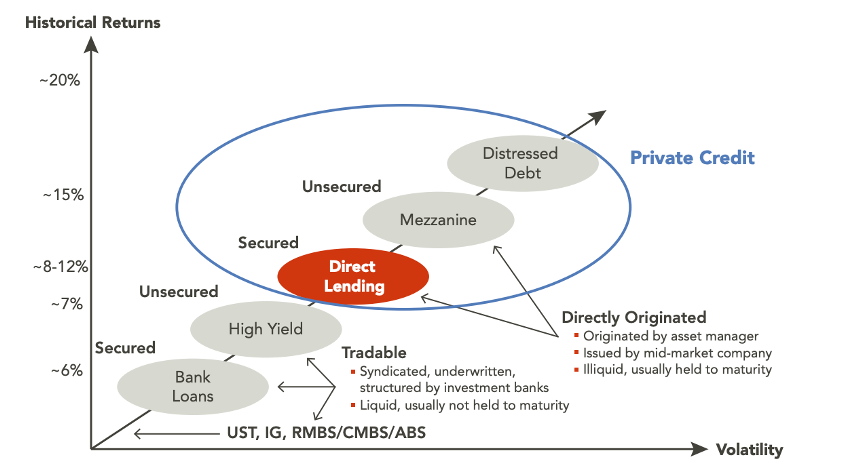

In this report, the authors reflect on the phenomenon of direct lending, which emerged in the second decade of the 21st century as one of the new forms of alternative financing to traditional banking and those provided by the capital markets. Among these alternative instruments, private debt funds stand out, aimed at financing business projects of various kinds. One of the most relevant subsets of this category of private debt is direct lending, which emerged after the Great Financial Crisis of 2008.

Through direct lending, the segment of small and medium-sized enterprises, which has always been highly dependent on bank financing, now has an alternative when it comes to financing the various needs it may have, such as organic growth, the acquisition of other companies or the restructuring of its debt maturities. Direct lending is also interesting from an investment point of view, as it makes available an asset class such as corporate loans. This new asset class has a higher return than similar markets such as bond markets, for example, although certain disadvantages such as lower liquidity or the usual lack of credit ratings must also be taken into account.

In short, this document describes the main characteristics of direct lending as a form of financing, which in turn constitutes an interesting alternative for investors. It aims to analyse in some detail the advantages and disadvantages of direct lending, the critical factors to be taken into account, as well as the economic, regulatory and sustainable policy framework in which this activity is being developed in Europe.