Since the beginning of 2022, Spanish companies are suffering various shocks that compromise their economic viability and financial survival.

On the one hand, there is the sharp rise in energy prices caused by the war in Ukraine and Russia’s reprisals. This increase in energy prices causes an increase in production costs that can rarely be passed on to the price, so that the reduction in margins is a reality.

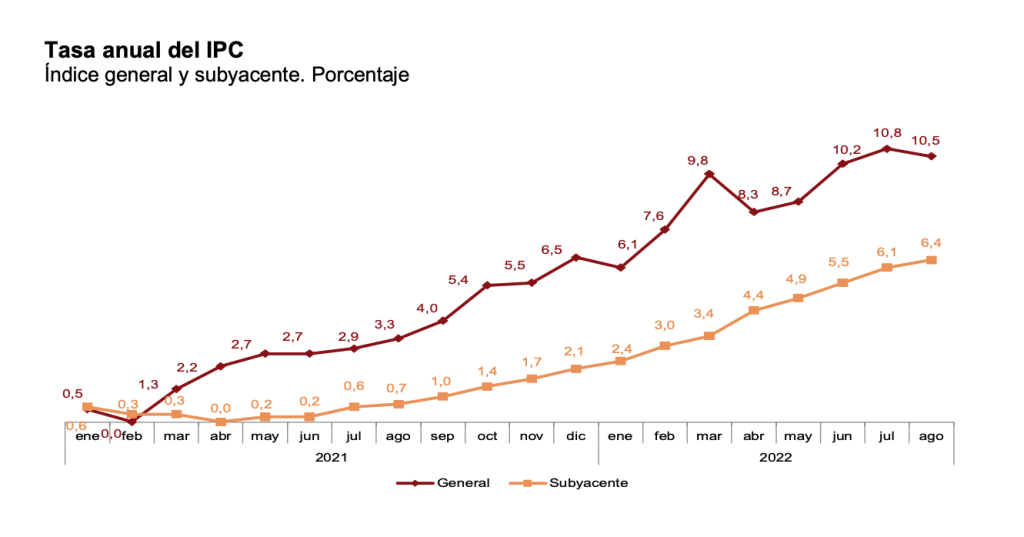

Another variable of great concern is the high inflation experienced over the past year, which does not seem to be abating. The generalised rise in prices, attributed both to the monetary expansion of recent years and to restrictions in the supply of goods resulting from the pandemic and the war, is particularly affecting small and medium-sized enterprises, which are generally unable to pass on this rise in the prices of their raw materials and supplies.

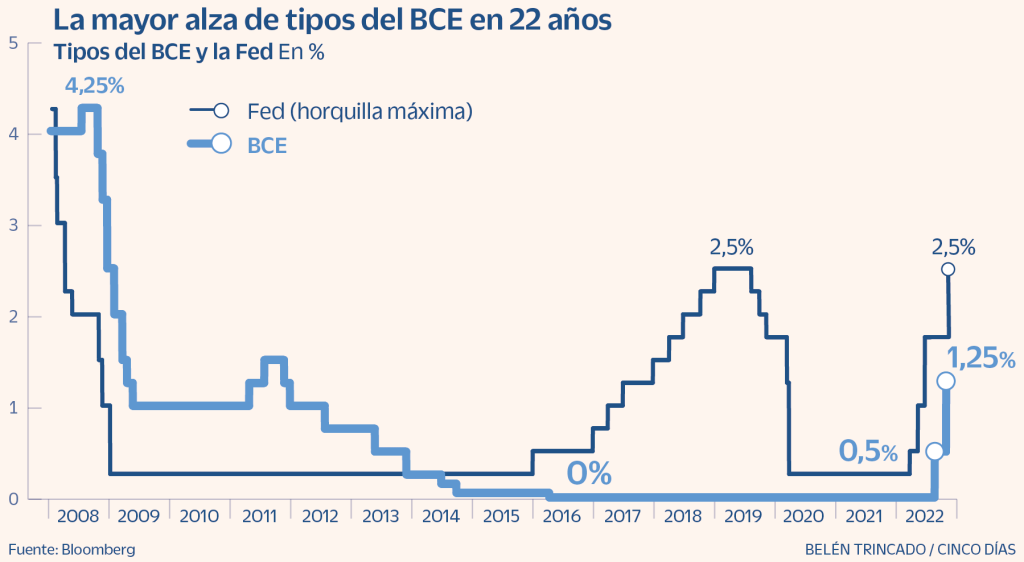

High inflation has motivated the latest interest rate hikes by the European Central Bank. Everything seems to indicate that, after the last increase of 0.75%, there will be further increases in the coming months. This will have a direct impact on all variable rate loans that companies have, as well as tightening the risk concession criteria of financial institutions.

Therefore, three risks (rising energy and raw material costs, high inflation and rising interest rates) that companies must manage and whose recipe in the financial sphere is far from simple, but which must necessarily involve diversification of sources of financing, both bank and alternative. Altria Corpo is, as always, there to help in this financial diversification.